Best etf on Reddit

334 reviews from r/ETFs, r/dividends, r/fiaustralia and 32 more subreddits

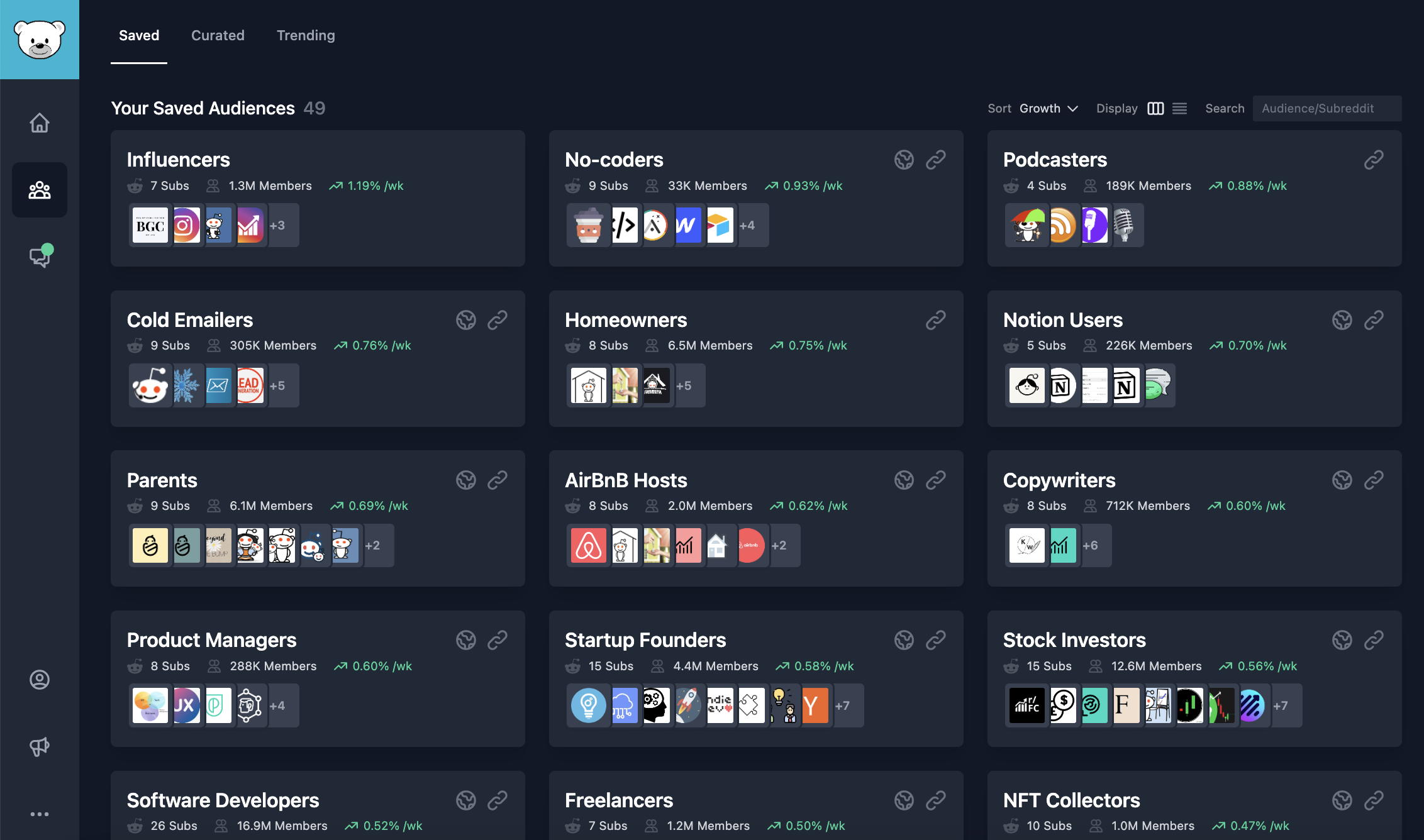

GummySearch is an audience research toolkit for 130,000 unique communities on Reddit.

If you are looking for startup problems to solve, want to validate your idea or find your customers online, GummySearch is for you.

Sign up for free, get community insights in minutes.