Best reit on Reddit

255 reviews from r/dividends, r/stocks, r/CanadianInvestor and 15 more subreddits

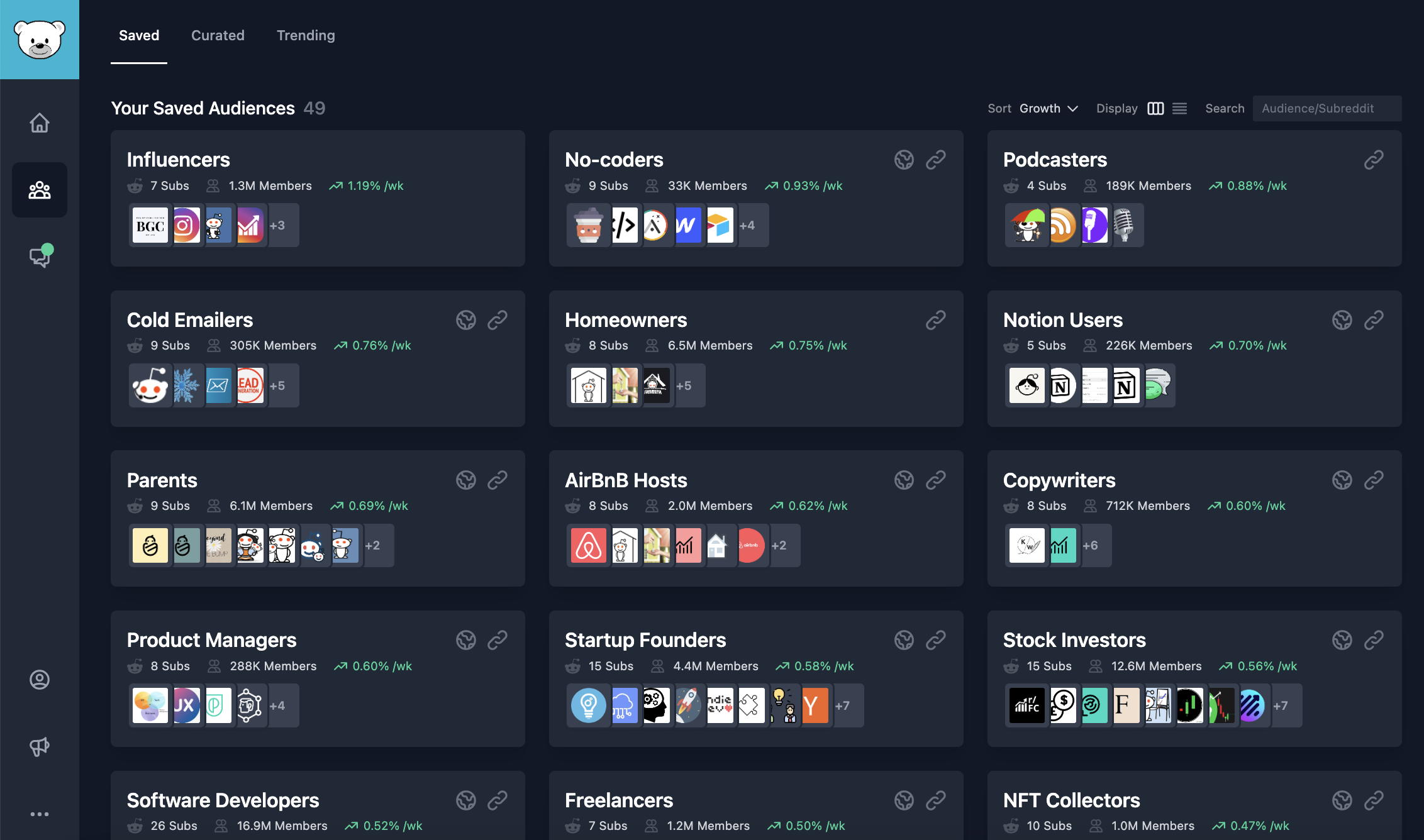

GummySearch is an audience research toolkit for 130,000 unique communities on Reddit.

If you are looking for startup problems to solve, want to validate your idea or find your customers online, GummySearch is for you.

Sign up for free, get community insights in minutes.